St Charles Parish Tax Rate . Sales tax rate lookup and sales tax item calculator. louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum sales tax rate in st charles. The current total local sales tax rate in saint charles parish, la is 9.450%. Charles parish sales tax rate is 5.0%. What is tangible personal property? what is the tax rate for st. the board has created and maintains the lookup tool to provide certain domicile information, including state and. Look up the current rate for a. The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. saint charles parish, la sales tax rate. Charles parish sales tax office. How do i register to pay sales.

from www.formsbank.com

The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. the board has created and maintains the lookup tool to provide certain domicile information, including state and. Sales tax rate lookup and sales tax item calculator. The current total local sales tax rate in saint charles parish, la is 9.450%. louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum sales tax rate in st charles. Charles parish sales tax rate is 5.0%. what is the tax rate for st. Charles parish sales tax office. What is tangible personal property? saint charles parish, la sales tax rate.

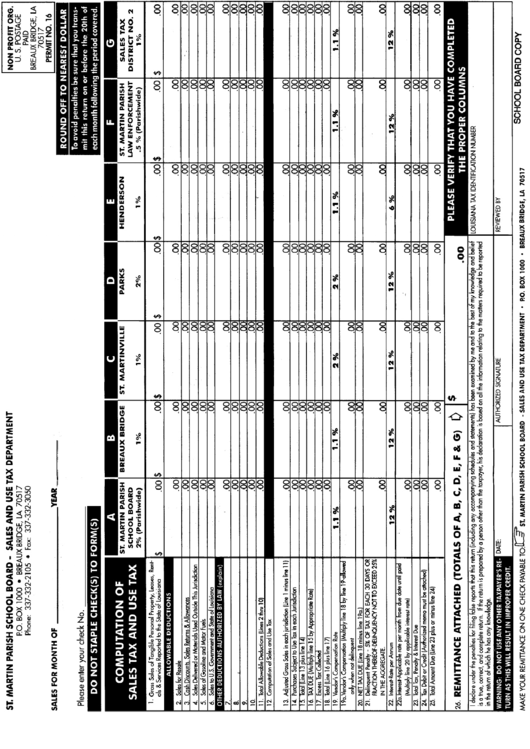

Sales And Use Tax Report Form St. Martin Parish School Board

St Charles Parish Tax Rate The current total local sales tax rate in saint charles parish, la is 9.450%. the board has created and maintains the lookup tool to provide certain domicile information, including state and. saint charles parish, la sales tax rate. How do i register to pay sales. The current total local sales tax rate in saint charles parish, la is 9.450%. Sales tax rate lookup and sales tax item calculator. What is tangible personal property? louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum sales tax rate in st charles. what is the tax rate for st. The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. Charles parish sales tax rate is 5.0%. Look up the current rate for a. Charles parish sales tax office.

From wgno.com

St. Charles Parish man arrested in connection to camp burglary St Charles Parish Tax Rate what is the tax rate for st. Charles parish sales tax rate is 5.0%. Look up the current rate for a. The current total local sales tax rate in saint charles parish, la is 9.450%. Sales tax rate lookup and sales tax item calculator. What is tangible personal property? The mission of the sales and use tax department is. St Charles Parish Tax Rate.

From www.msn.com

Hot Seat St. Charles Parish President debate St Charles Parish Tax Rate saint charles parish, la sales tax rate. The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. Charles parish sales tax office. louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum sales tax rate in st charles. What is tangible. St Charles Parish Tax Rate.

From geographicallyyourswelcome.blogspot.com

Geographically Yours St. Charles Parish, Louisiana St Charles Parish Tax Rate Charles parish sales tax office. What is tangible personal property? Sales tax rate lookup and sales tax item calculator. Charles parish sales tax rate is 5.0%. what is the tax rate for st. The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. saint charles parish, la sales. St Charles Parish Tax Rate.

From www.formsbank.com

Sales And Use Tax Report Form St. Martin Parish School Board St Charles Parish Tax Rate Look up the current rate for a. Charles parish sales tax rate is 5.0%. what is the tax rate for st. Sales tax rate lookup and sales tax item calculator. The current total local sales tax rate in saint charles parish, la is 9.450%. the board has created and maintains the lookup tool to provide certain domicile information,. St Charles Parish Tax Rate.

From www.neilsberg.com

St. Charles Parish, LA Median Household By Age 2023 Neilsberg St Charles Parish Tax Rate The current total local sales tax rate in saint charles parish, la is 9.450%. Sales tax rate lookup and sales tax item calculator. saint charles parish, la sales tax rate. the board has created and maintains the lookup tool to provide certain domicile information, including state and. louisiana has a 4.45% sales tax and st charles parish. St Charles Parish Tax Rate.

From www.theadvocate.com

Thousands in St. Charles Parish may be eligible for lower flood St Charles Parish Tax Rate the board has created and maintains the lookup tool to provide certain domicile information, including state and. what is the tax rate for st. What is tangible personal property? Look up the current rate for a. louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum sales tax rate in. St Charles Parish Tax Rate.

From diaocthongthai.com

Map of St. Charles Parish, Louisiana Thong Thai Real St Charles Parish Tax Rate How do i register to pay sales. Charles parish sales tax office. What is tangible personal property? Sales tax rate lookup and sales tax item calculator. Look up the current rate for a. The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. saint charles parish, la sales tax. St Charles Parish Tax Rate.

From leeanneodolley.pages.dev

St Charles Parish Louisiana Map Emilia Natividad St Charles Parish Tax Rate what is the tax rate for st. The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. The current total local sales tax rate in saint charles parish, la is 9.450%. How do i register to pay sales. Look up the current rate for a. saint charles parish,. St Charles Parish Tax Rate.

From cevlvdit.blob.core.windows.net

St Charles Parish Real Estate Transfers 2019 at Sheila Robinson blog St Charles Parish Tax Rate Look up the current rate for a. saint charles parish, la sales tax rate. louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum sales tax rate in st charles. How do i register to pay sales. the board has created and maintains the lookup tool to provide certain domicile. St Charles Parish Tax Rate.

From www.stcharlesparish.gov

Important Notices St. Charles Parish, LA St Charles Parish Tax Rate Look up the current rate for a. saint charles parish, la sales tax rate. Charles parish sales tax rate is 5.0%. The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum. St Charles Parish Tax Rate.

From www.wwltv.com

St. Charles Parish Louisiana Election Results 2022 St Charles Parish Tax Rate How do i register to pay sales. Sales tax rate lookup and sales tax item calculator. The current total local sales tax rate in saint charles parish, la is 9.450%. Charles parish sales tax office. the board has created and maintains the lookup tool to provide certain domicile information, including state and. What is tangible personal property? The mission. St Charles Parish Tax Rate.

From www.formsbank.com

Sales And Use Tax Report St. Charles Parish printable pdf download St Charles Parish Tax Rate louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum sales tax rate in st charles. Charles parish sales tax office. saint charles parish, la sales tax rate. what is the tax rate for st. How do i register to pay sales. What is tangible personal property? the board. St Charles Parish Tax Rate.

From www.nola.com

4.8 million hurricane levee tax proposed in St. Charles Parish Local St Charles Parish Tax Rate Sales tax rate lookup and sales tax item calculator. The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. How do i register to pay sales. Charles parish sales tax rate is 5.0%. louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the. St Charles Parish Tax Rate.

From issuu.com

St. Charles Parish Draft Comprehensive Plan Update by Lyneisha Jackson St Charles Parish Tax Rate Sales tax rate lookup and sales tax item calculator. The current total local sales tax rate in saint charles parish, la is 9.450%. the board has created and maintains the lookup tool to provide certain domicile information, including state and. What is tangible personal property? Charles parish sales tax office. louisiana has a 4.45% sales tax and st. St Charles Parish Tax Rate.

From exowtyxpg.blob.core.windows.net

St Charles Parish Zip Code Map at Leo Munoz blog St Charles Parish Tax Rate The mission of the sales and use tax department is to fairly and equitably administer the sales and use tax. Charles parish sales tax office. The current total local sales tax rate in saint charles parish, la is 9.450%. How do i register to pay sales. Sales tax rate lookup and sales tax item calculator. louisiana has a 4.45%. St Charles Parish Tax Rate.

From www.formsbank.com

Sales And Use Tax Report St.charles Parish School Board Sales And Use St Charles Parish Tax Rate The current total local sales tax rate in saint charles parish, la is 9.450%. Look up the current rate for a. what is the tax rate for st. Charles parish sales tax rate is 5.0%. louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum sales tax rate in st charles.. St Charles Parish Tax Rate.

From www.formsbank.com

Sales And Use Tax Report Form St. Charles Parish School Board St Charles Parish Tax Rate Charles parish sales tax rate is 5.0%. what is the tax rate for st. Sales tax rate lookup and sales tax item calculator. saint charles parish, la sales tax rate. What is tangible personal property? louisiana has a 4.45% sales tax and st charles parish collects an additional 5%, so the minimum sales tax rate in st. St Charles Parish Tax Rate.

From bellamaterials.com

Saint Charles Parish, Louisiana Bella Sand and Rock St Charles Parish Tax Rate Charles parish sales tax office. The current total local sales tax rate in saint charles parish, la is 9.450%. what is the tax rate for st. What is tangible personal property? Sales tax rate lookup and sales tax item calculator. Look up the current rate for a. the board has created and maintains the lookup tool to provide. St Charles Parish Tax Rate.